In 2020, according to OPEC secondary sources, the country’s oil production reached an average of 1.262 million barrels/day, which corresponds to a reduction of 139 thousand barrels/day compared to 2019. National production accounted for around 5% of the total produced by OPEC, as the second largest producer in Africa.

Expectations regarding the economy’s performance in the short term, collected from national entrepreneurs, recorded a downward trajectory in 2020. The decrease recorded in 2020 reflects the impact of the Covid-19 pandemic – restrictions on imports and moderation of demand – coupled with the ongoing exchange rate depreciation and its impacts on inflation. However, of the seven sectors analysed by the Economic Climate Indicator (ECI), the Communication Confidence Indicator remained positive by 7 points in the third quarter of 2020. The worst record concerns the Construction Confidence Indicator with -47 points – a sector with a significant component of imports and dependence on public investments, which were channelled to pandemic control.

PRICE LEVEL

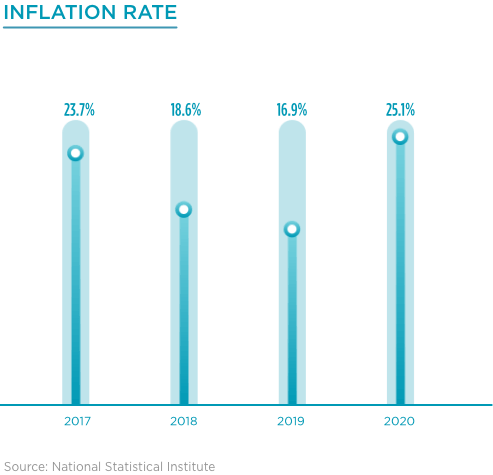

The annual National inflation rate for 2020 closed at 25.10%, the highest level since December 2017, when it stood at 23.67%.

The annual variation of the Consumer Price Index stood above the target of 25.0% presented in the State Budget (SB) for 2020, pressured by the constraints on production and imports intensified by Covid-19, taking into account the process of exchange rate depreciation underway in the economy.

BANKING SECTOR

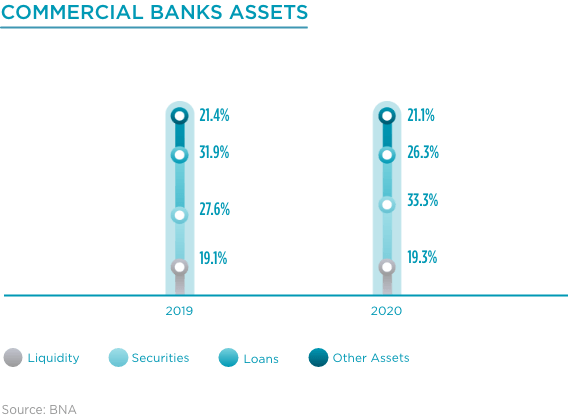

The assets of the banking sector stood at AOA 21,734.37 billion, in 2020, an increase of 18.25% when compared with the previous year. The item Financing to the economy accounted for 26.3% of assets, while government securities represented 33.3%, a reduction of 5.6 and an increase of 5.7 p.p., respectively. On the other hand, liabilities were concentrated in deposits by 66.4%, with 74.4% of total deposits representing private sector deposits.

Regarding the soundness of the banking sector, it is noted that the solvency ratio recorded an annual increase of 0.71 p.p., to 28.17%, in July 2020. Return on Net Assets (RONA) reached 5.0%, an increase of 4.32 p.p. since July 2019. At the same time, Return on Assets (ROA) stood at 0.50%, corresponding to an increase of 0.41 p.p. when compared to July 2019.

MONEY MARKET

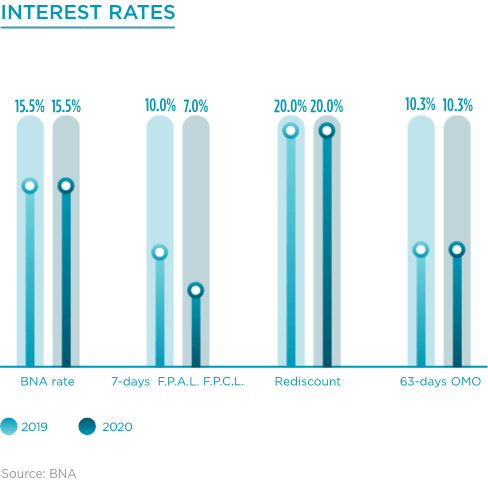

The target of controlling inflation, in the face of the continuous process of currency devaluation, has contributed to the adoption of a restrictive monetary policy. Meanwhile, in 2020, in view of the need to address the impacts of the Covid-19 pandemic on the economy, the BNA also introduced stimuli to the economy.

In 2020, the BNA’s Monetary Policy Committee (MPC) kept the benchmark interest rate at 15.5%, the coefficient of mandatory reserves in national currency at 22% and made notes and coins ineligible. Additionally, BNA decided to reduce the 7-day liquidity absorption interest rate by 3 p.p., to 7.0%, and increased the coefficient of mandatory reserves in foreign currency by 2.0 p.p., to 17% — the constitution of the differential should be carried out using the national currency.

EXCHANGE MARKET AND EXTERNAL SECTOR

The stimulation of the foreign exchange market characterised 2020 with the entry of new suppliers of foreign currency, as in the case of oil companies, diamond companies and the National Treasury, the possibility of direct negotiations through the Bloomberg platform and the adoption of currency forwards, which minimises the impact of exchange rate depreciation through the possibility of defining the exchange rate and the future maturity date within a maximum of one year, according to data disclosed in Notice no. 22/2020, of 23 November.

The maintenance of the foreign exchange market liberalisation process and the improvement in access to foreign currency have contributed to reducing the differential between the official and parallel markets. It should be noted that the exchange rate differential against the Dollar went from 150% in 2017 (when the new foreign exchange regime was implemented) to around 16% in December 2020.

CAPITAL MARKET

In 2020, Treasury estimated the issue of Treasury Bonds in the amount of AOA 1398.33 billion and Treasury Bills in the amount of AOA 1041.02 billion, with demand set at approximately 57.08% and 121.39%, which may reflect the preference for short-term assets, as a result of uncertainty about the long-term performance of the economy. The 2020 Annual Borrowing Plan showed an annual increase of 57.8% in the amount of Treasury Bonds and 23.44% in total Treasury Bill issues.

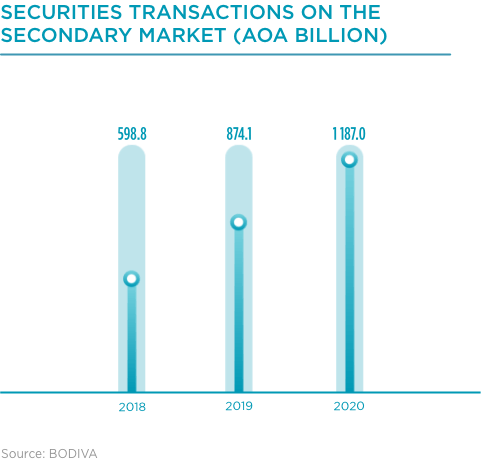

Treasury Bond transactions, on the secondary market, stood at AOA 1187.03 billion in 2020, an increase of 35.80% compared to the same period in 2019.