Credit risk

Credit risk management is based on a set of policies and guidelines established according to business strategies and risk profile of the institution. In addition to the regulations, the granting of credit is supported by the assessment and classification of the Customer’s risk with the support of scoring and rating models, and the assessment of the level of collateral coverage of operations.

Market and liquidity risk

The assessment of liquidity risk is based on the calculation and analysis of indicators that allow the Bank’s liquidity situation to be identified for short-term horizons. The monitoring of current and structural liquidity levels, according to the amounts and deadlines of commitments and resources in the portfolio, is carried out through the identification of liquidity gaps, for which exposure limits are defined.

Solvency risk

Foreseeing the potential impacts of the Covid-19 pandemic, the Bank did not distribute in 2020 the 2019 profits in the form of dividends, in order to maintain the ratio in line with the established risk appetite. Additionally, within the scope of the reinforcement of impairment associated with the downgrade of Angola's rating, the impact was mitigated through the results generated by the Bank up to the end of the year.

Cyber risk

The threat landscape is changing at a rapid pace and this change has challenged companies' adaptability. To this end, ATLANTICO is increasingly investing in automation and machine learning technologies for the analysis of events, in order to deal with constantly changing threat scenarios. ATLANTICO continues to actively manage cyber risk to contribute to the need to safeguard its Customers, its Ecosystem and, consequently, the national economy.

COMPLIANCE

There is a growing concern, both from ATLANTICO and the regulatory authorities, to implement procedures to control exposure to the risk of Money Laundering and Terrorist Financing, in order to reduce the likelihood of the Bank being used as vehicle for the circulation of funds with illegal origins and/or uses.

For the purposes of Customer analysis and assessment, ATLANTICO guarantees the daily screening of its Customer database against lists of Sanctions and PEP – Politically Exposed Person, namely OFAC – Office of Foreign Assets Control, BOE – Boletin Oficial Del Estado – Espanha, EU – European Union, PEP – Politically Exposed Person, UN – United Nations and HMT – HM Treasury, as well as internal lists of bad guys and other lists that the Angolan State may consider.

INTERNAL AUDIT

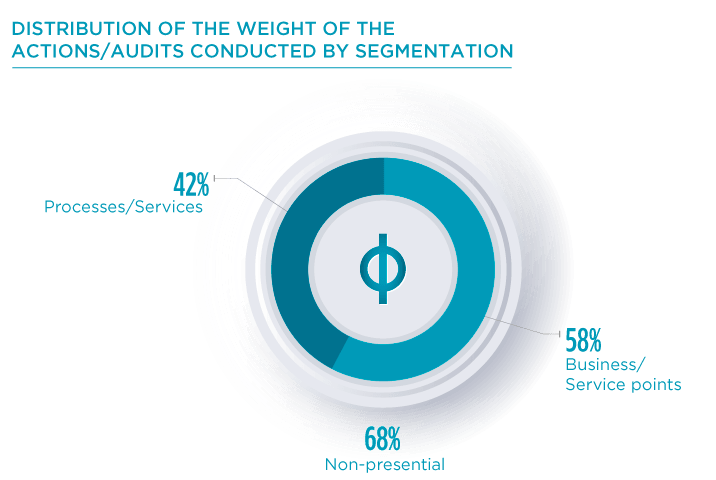

In 2020, we adapted the Internal Audit strategy to the pandemic context:

- Reallocation of Employees to activities considered critical (e.g. fraud and complaints and remote control);

- Revision of the Plan defined for 2020, in order to adapt it to this context;

- Partial and remote audits were defined for service points, instead of general and face-to-face audits, keeping the most critical processes;

- Strengthening of management and control of Treasury departments at service points in the non-face-to-face mode (online);

- Continuous monitoring of controls/alerts regarding processes and operations.