Executive Committee

Impact on the ATLANTICO’s Ecosystem

People

“Promote individual and professional development of ATLANTICO’s Family by creating values for life and transforming lives”

Customers

“Deliver an outstanding service to Customers”

Shareholders

“Protect and maximize Shareholders’ equity, in a whole and sustainable way”

Regulatory Agencies

“Acting strictly and in line with the best practices in the financial industry”

IMPROVEMENT OPPORTUNITIES

Partners

“Build and foster partnerships, where we grow and strengthen together”

BUSINESS PARTNER NETWORK:

- INSURANCE

ASSET MANAGEMENT

26 CORRESPONDENT BANKS IN 4 CONTINENTS

Communities

“Leave a footprint in Society, contributing to the transformation of their lives in a sustainable manner creating values for life”

Strategic Pillars

Strategic Pillars

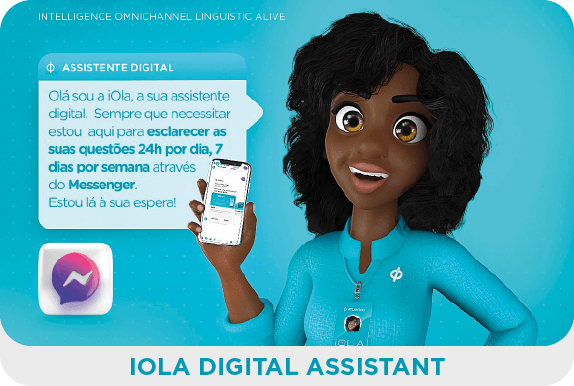

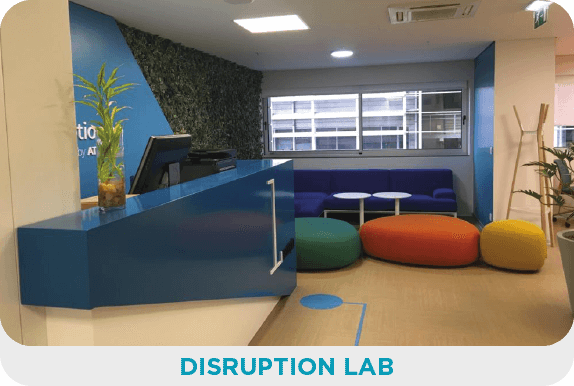

In line with the 2020 motto, which is to secure return on investments, ATLANTICO focused on improving Customer experience by optimising digital solutions and continued its ambitious plan to digitalise core processes.

ATLANTICO's ambition is to transform its position as universal bank, in the service to its Customers: "Serve all, always, where and how they choose".

ATLANTICO maintained its strategy of boosting business with international partners (Banking and Multilateral Financial Institutions) in order to ensure ongoing support to Customers for their investment, payment and trade finance business needs. The correspondence network includes 130 banks, of which of which ATLANTICO maintains an active transactional relationship with 26, present in the main geographies that maintain a relationship with the Angolan market.

Through its Investment Banking solutions, ATLANTICO is positioned as a reference in this business segment, with a track record of support for investment in Angola and Angolan investment in international markets. As to Capital Markets, in 2020, in the Securities Intermediation segment, the Bank consolidated its position in the BODIVA market ranking as the third largest intermediary in trading volume.

1) 72% market share for export operations.

ATLANTICO's ambition to be the "Best Bank in Customer Service", based on pillars such as Universality, Efficiency and Agility, represents a challenge of internal transformation, capacity building and skills recycling, the introduction of new and different work methodologies.

Driven by Customer primacy, ATLANTICO believes that its purpose is achieved through its greatest intangible asset: the ATLANTICO Culture, sustained by our Values for Life.

Social Transformation is a foundational pillar of ATLANTICO, with the sharing of the results of its activity with the Community in which it operates in its DNA, leaving a relevant mark on society. Its Founders have created an Institution based on the creation of Values for Life. An Institution that generates values for its Customers, for Shareholders, People and, above all, Society.

ATLANTICO’s Social Transformation strategy defines the following areas of action:

In line with the 2020 motto, which is to secure return on investments, ATLANTICO focused on improving Customer experience by optimising digital solutions and continued its ambitious plan to digitalise core processes.

ATLANTICO's ambition is to transform its position as universal bank, in the service to its Customers: "Serve all, always, where and how they choose".

ATLANTICO maintained its strategy of boosting business with international partners (Banking and Multilateral Financial Institutions) in order to ensure ongoing support to Customers for their investment, payment and trade finance business needs. The correspondence network includes 130 banks, of which of which ATLANTICO maintains an active transactional relationship with 26, present in the main geographies that maintain a relationship with the Angolan market.

Through its Investment Banking solutions, ATLANTICO is positioned as a reference in this business segment, with a track record of support for investment in Angola and Angolan investment in international markets. As to Capital Markets, in 2020, in the Securities Intermediation segment, the Bank consolidated its position in the BODIVA market ranking as the third largest intermediary in trading volume.

* 72% market share for export operations.

ATLANTICO's ambition to be the "Best Bank in Customer Service", based on pillars such as Universality, Efficiency and Agility, represents a challenge of internal transformation, capacity building and skills recycling, the introduction of new and different work methodologies.

Driven by Customer primacy, ATLANTICO believes that its purpose is achieved through its greatest intangible asset: the ATLANTICO Culture, sustained by our Values for Life.

Social Transformation is a foundational pillar of ATLANTICO, with the sharing of the results of its activity with the Community in which it operates in its DNA, leaving a relevant mark on society. Its Founders have created an Institution based on the creation of Values for Life. An Institution that generates values for its Customers, for Shareholders, People and, above all, Society.

ATLANTICO’s Social Transformation strategy defines the following areas of action: