Key indicators

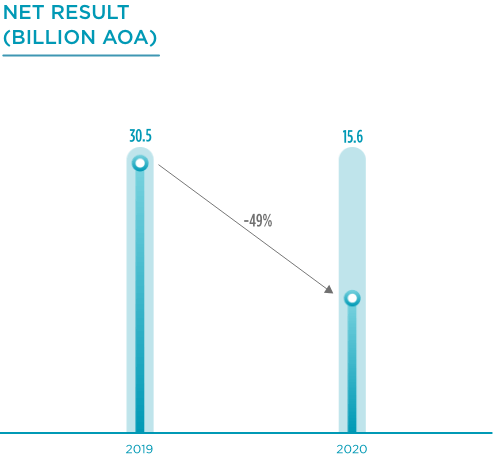

15.6

AOA billion

-49%

Net result

9.6%

-13 p.p.

Return on Equity

0.9%

+1.2 p.p.

Return on Assets

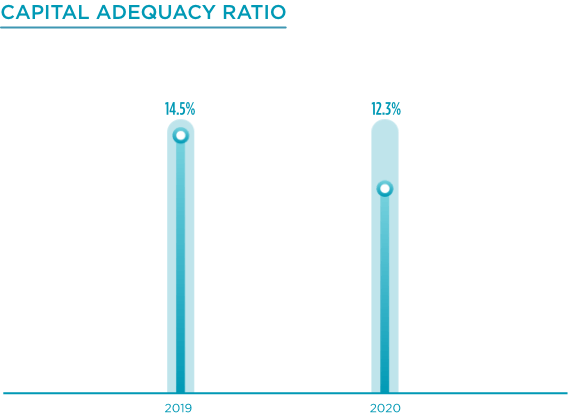

12.3%

-2.2 p.p.

Solvency Ratio

108.4

AOA billion

+5.6%

Bank Product

48.8

AOA billion

-21%

Operating costs

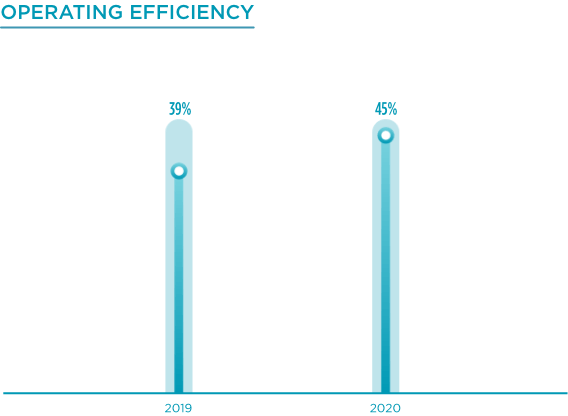

45%

+5.6 p.p.

Cost-to-income

1,750

AOA billion

+9.3%

Assets

1,524

AOA billion

+23%

Deposits from Customers

454

AOA billion

+3%

Net credit

21.5%

+5.78 p.p.

Credit at Risk

119.4%

-10.62 p.p.

Coverage of Credit Risk

NET RESULTS

ATLANTICO ended 2020 with net results of 15.6 billion Kwanzas, a decrease of 49% compared to the same period last year. This reduction is strongly impacted by the following factors:

a) Decrease of net interest income resulting from the combined effect of increased deposit remuneration costs and decrease of active interest;

b) Significant reinforcement of impairments to cover expected losses in the loan portfolio and public debt securities;

c) Decrease of exchange rates;

d) Decrease of commissioning;

e) Increase in operating costs.

The decrease in results is influenced by the adverse implications that the challenging context generated by the pandemic in 2020 has for the national economy and for the banking sector. However, despite the adversities that were imposed, the Bank continues to present a solid and positive result in 2020.

SOLVENCY

OPERATING EFFICIENCY