Key indicators

30.5

AOA billion

+12%

Net income

23%

-8.8 p.p.

Return on equity

2.1%

+0.03 p.p.

Return on assets

14.5%

-1.2 p.p.

Capital adequacy ratio

111

AOA billion

+5%

Operating income

40

AOA billion

-8.2%

Operating costs

47%

-2 p.p.

Cost-to-income (recurring)

1,601

AOA billion

+17.9%

Net assets

1,235

AOA billion

+18.4%

Deposits from Customers

443

AOA billion

+2.8%

Net loans

15.7%

-1.2 p.p.

Credit at risk ratio

130%

+29 p.p.

Credit at risk coverage ratio

Business performance

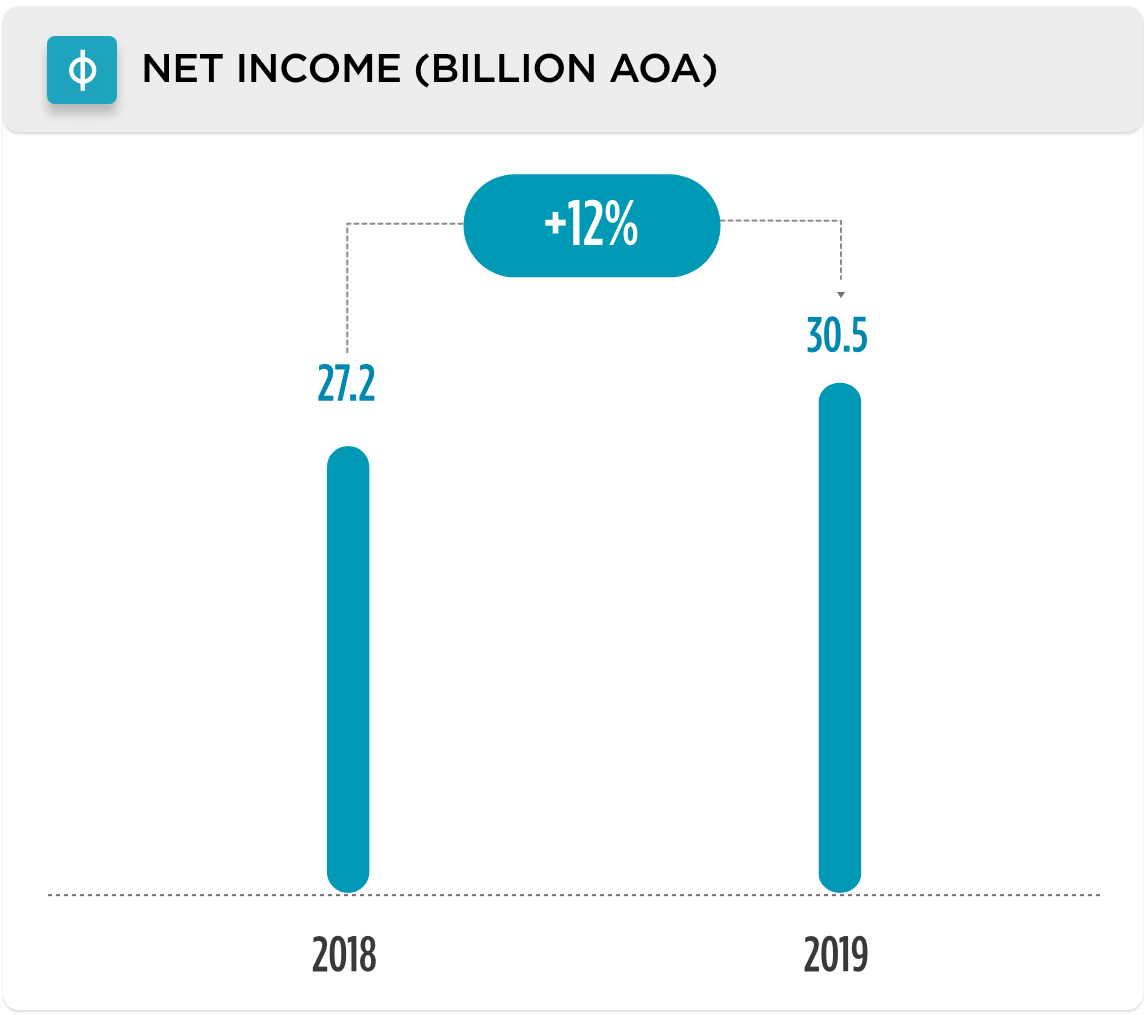

The Bank closed 2019 with net results in the amount of AOA 30.5 billion, representing a 12% growth compared to the previous period, however below the forecast.

The level of impairments was significantly reinforced by an approximate amount of AOA 31 billion increasing its credit-at-risk coverage ratio to 130%.

In December, Capital adequacy ratio stood at 14.5%, reflecting a -1.2 p.p. decrease compared to the same period. Therefore, ATLANTICO continues to present solid ratios and availability of capital to support business growth and risks of Bank activity.

The Cost-to-income ratio reached 39%, representing a deviation of -3 p.p. against the previous year. If we exclude non-recurring events that occurred at the level of revenue, cost-to-income ratio reaches 47%, with a favorable evolution of 2 p.p. compared the previous period. The improvement of efficiency levels is one of the Bank’s fundamental focuses, defining strict objectives for each business cycle.

Download Center

Download Center