3.0

ATLANTICO

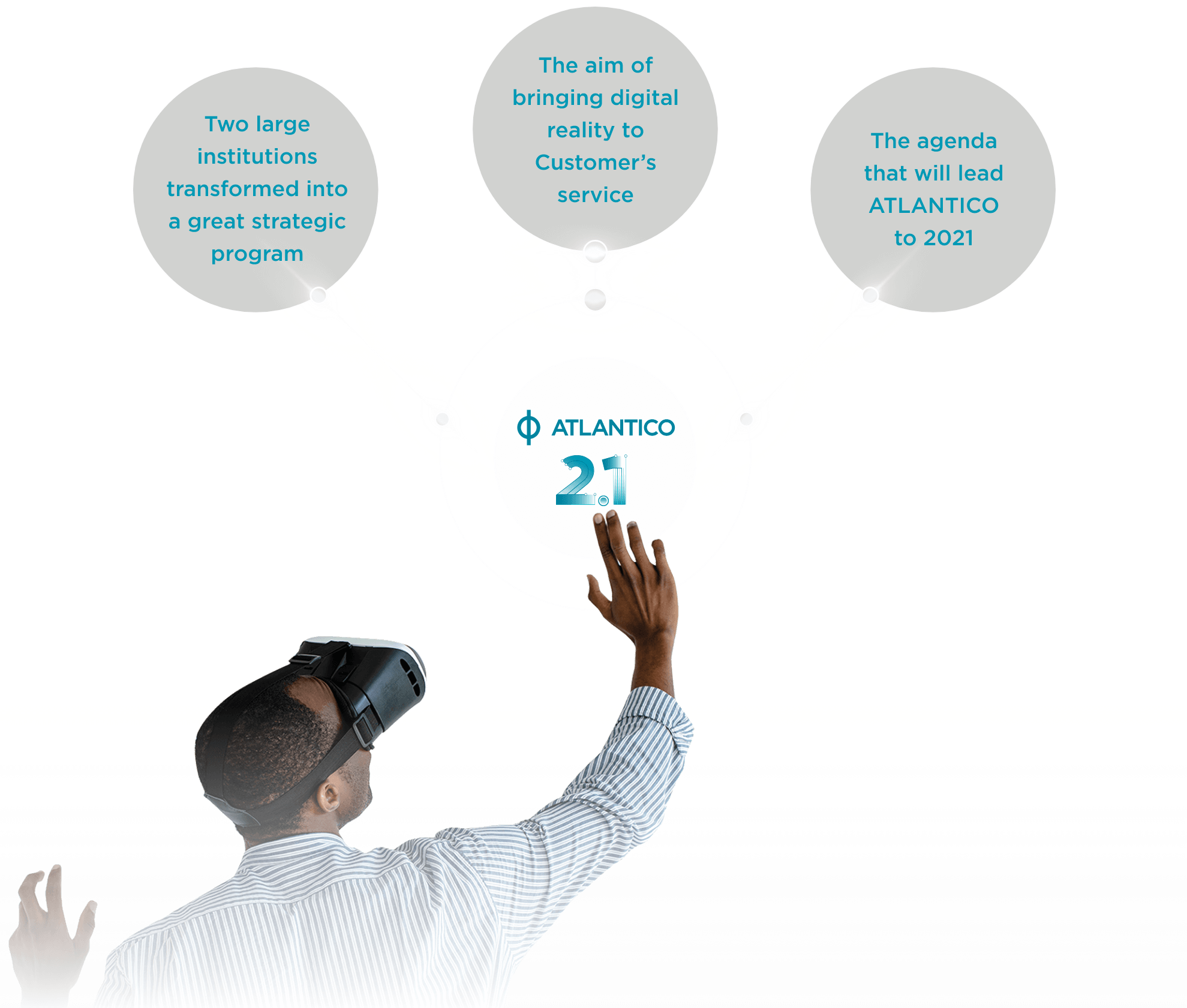

Founded in 2006, ATLANTICO incorporated Banco Millennium Angola in 2016. As a result of this merger and integration process of operations of both banking institutions, which together have more than 20 years of experience, ATLANTICO consolidated its universal character and strengthened its position in the Angolan banking market, becoming the largest private bank in financing Angolan Companies and Households and strengthening its position as one of the largest banks in the banking sector.

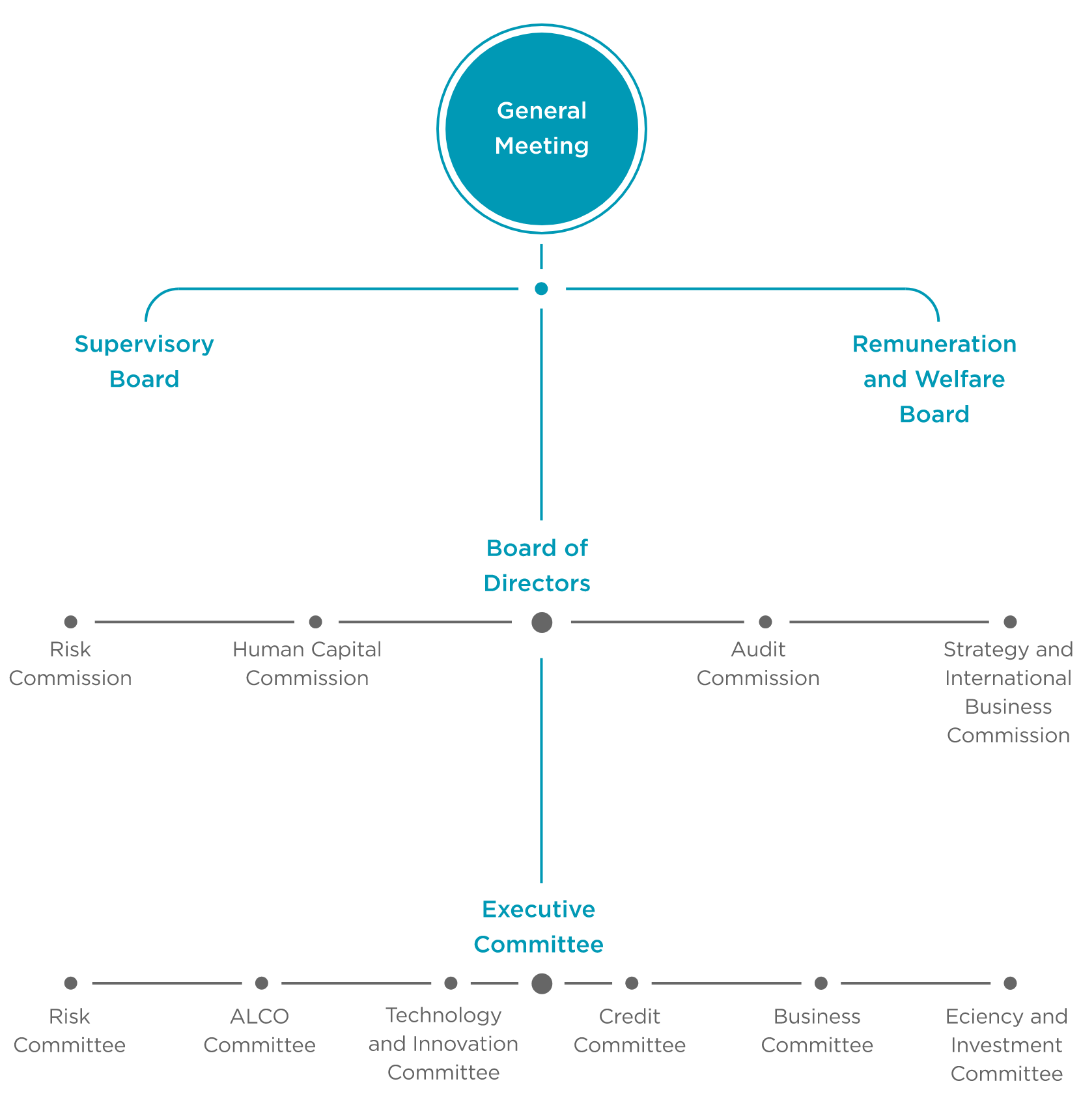

Executive Committee

Our commitment to ATLANTICO’s Ecosystem

Customers

“Deliver an outstanding service to Customers”

Shareholders

“Protect and maximize Shareholders’ equity, in a whole and sustainable way”

Regulatory Agencies

“Acting strictly and in line with the best practices in the financial industry”

Partners

“Build and foster partnerships, where we grow and strengthen together”

BUSINESS PARTNER NETWORK:

- INSURANCE

- ASSET MANAGEMENT

- CORRESPONDENT BANKS IN 4 CONTINENTS

Communities

“Leave a footprint in Society, contributing to the transformation of their lives in a sustainable manner, creating values for life”

People

“Promote individual and professional development of ATLANTICO’s Family by creating values for life and transforming lives”

Our strategic Agenda is based on five pillars

Universal

ATLANTICO’s ambition is to transform its position as universal bank, in the service to its Customers: “Serve all, always, where and how they choose”.

In 2018, through its digital vision, ATLANTICO has transformed its processes as a way to make them simpler and more agile and innovated in the solutions made available to Customers, providing them with greater availability, autonomy and proximity to the Bank. It also expanded its customer base, regardless of the segment. By 2021, ATLANTICO aims to increase its Customer base to 2 million.

Mass Market

For the segment of private individuals and small businesses, whose transaction needs are greater, ATLANTICO bets on a universal positioning, where the Customer chooses at which service point wants to be served, and aims to be closer to Customers. Another critical success factor is the quality of the service provided, based on digital, simple, agile and autonomous processes for the Customer.

In 2018, the Bank concluded the expansion of the breakthrough digital onboarding solution to the entire network of service points, providing fully digital and agile experience during the opening of bank accounts. In the path towards process automation, ATLANTICO continued to innovate with the availability of Direct Deposit Machines, allowing the execution of small deposits autonomously, safely and conveniently, every day of the week and 24 hours a day, thus meeting Customer’s needs.

Prestige

Private Banking

Corporate

Large Corporate

Innovative

ATLANTICO positions itself as an innovative and digital bank, aiming to be “Leader in digital transformation”.

ATLANTICO’s digital transformation footprint is already very relevant, standing out as leader in this field in the Angolan financial sector. To this end, the Bank has sought to digitize its core processes and develop innovative solutions to improve the Customer experience and, simultaneously, extend the time that ATLANTICO’s People have available to add more value to Customers.

Onboarding Digital

Digital Branch

Direct Deposit Machine

Disruption Lab

100% Digital Account Opening

Investment Partner

ATLANTICO aims to be a benchmark partner in the investment to and from Angola, in order to continue to support Angola’s affirmation in the world and the diversification of the Angolan economy. To this end, it has focused on consolidating the network of international partners and strengthening the leading role in investment banking.

The Bank has outlined a strategy for the growth of its network of international correspondent banks and the establishment of relations with multilateral development financial institutions with the objective of accessing external credit facilities to support investment and the trade finance activity.

Multi-geographic positioning

Agile and Customer-driven

ATLANTICO’s plan is to be an agile and Customer-driven organization with the ambition to be the “Best Bank in Customer Service”.

Guided by the Customer’s primacy, ATLANTICO believes that its plan is achieved through its largest intangible asset: ATLANTICO’s Culture. A unique culture made of, by and for People. In 2017, ATLANTICO renewed its commitment to each element of its ecosystem, rebuilding its mission and the corporate values that sustain its culture “Our Values for Life”: Customer driven, People Development, Innovation, Agility and Efficiency and Accuracy.

Responsible

ATLANTICO aims to “Leave a footprint in Society, contributing to the transformation of their lives in a sustainable manner, creating values for life”.

Social Transformation is a foundational pillar of ATLANTICO. Its Founders have created not only a Bank but also an Institution based on the creation of Values for Life. A new generation Institution, creating more value for Customers, for its People, for Shareholders and, above all, for Society, striving for the transformation of lives and committed to its Ecosystem.

This transforming impact begins in the lives of Employees and their Families, ATLANTICO’s People, in their welfare, stability and sustainability, extending to the Communities and the entire ATLANTICO Ecosystem. In 2018, over 800 ATLANTICO’s volunteers invested more than 3,500 hours in Communities. Their commitment, sense of mission and humanism allowed us to impact more than 16,000 lives and create more than 70 direct and indirect jobs.