ATLANTICO

An institution that generates value for its Customers, Shareholders, People and, above all, for the Communities. A bank that promotes digital innovation and focuses on financial inclusion, creating a partnership’s Ecosystem and committing to the future.

AN EXPERIENCE OF EXCELLENCE

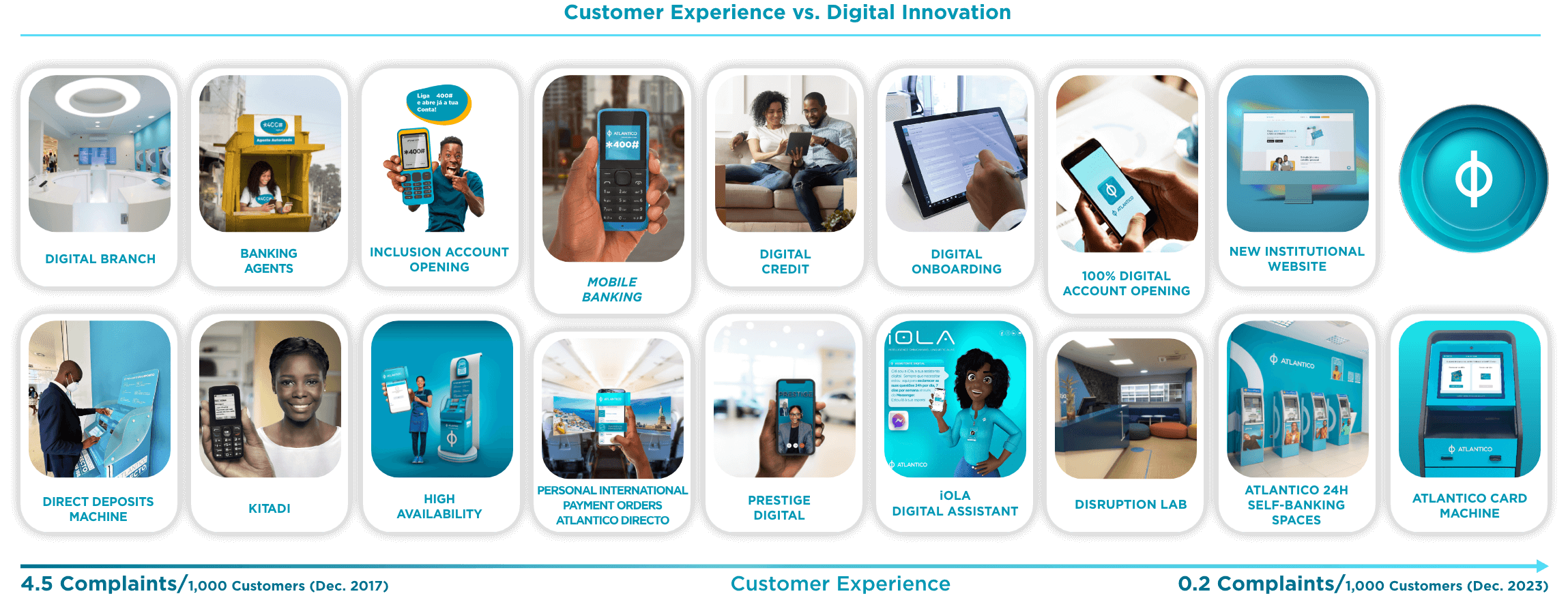

ATLANTICO acknowledges that providing an excellent customer experience requires a steadfast commitment to Customers and the continuous development and training of its Talents, as human beings and professionals. It is this unavoidable commitment that sets ATLANTICO apart in providing a differentiated Customer experience from Cabinda to Cunene, 24 hours a day.

USING INNOVATION

TO BETTER SERVE

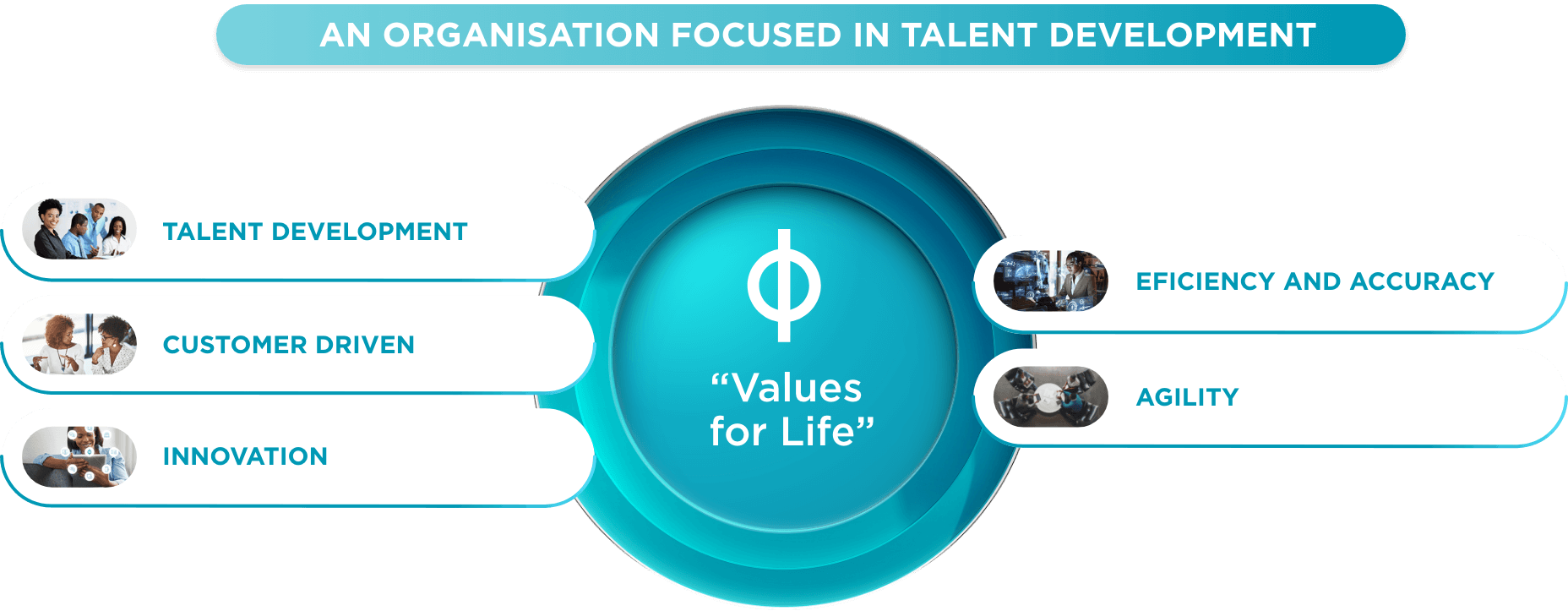

Innovation is a fundamental principle of ATLANTICO's operations and is present in the organization's day-to-day activities. This ensures that the Company can serve its Customers better. To accelerate its innovation processes, ATLANTICO has made several changes to its organizational structure. This includes introducing new management practices that promote more agile models in the creation and delivery of new products and services.

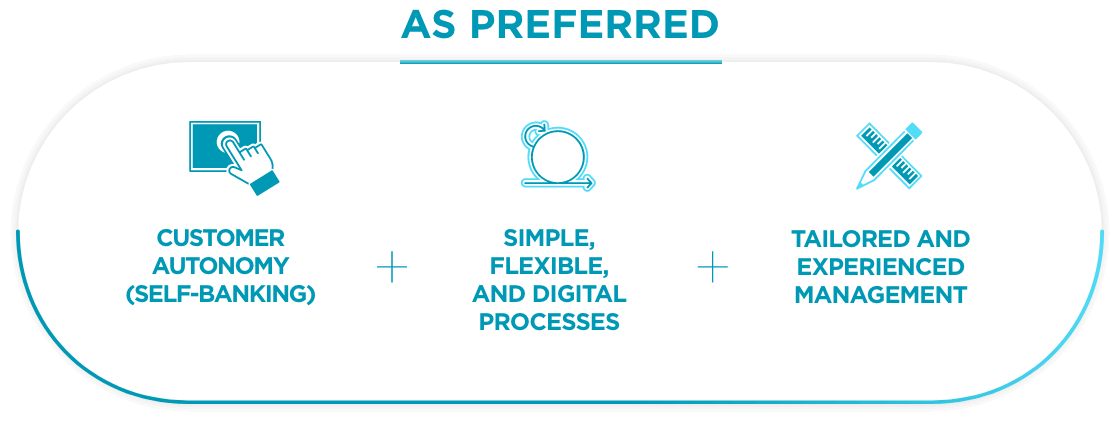

SCALABLE BUSINESS MODEL

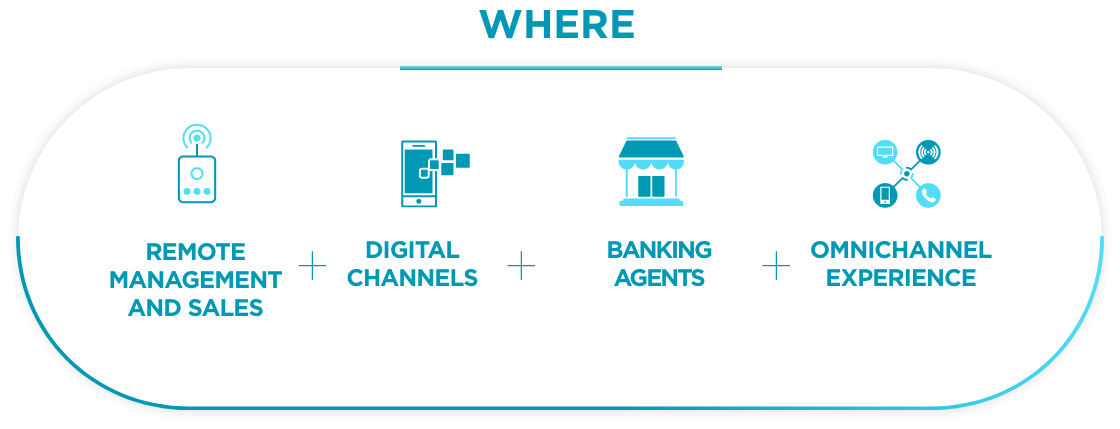

ATLANTICO is committed to a scalable business model that allows it to provide its Clients with an excellent banking experience. Its business model is based on the following fundamental principles:

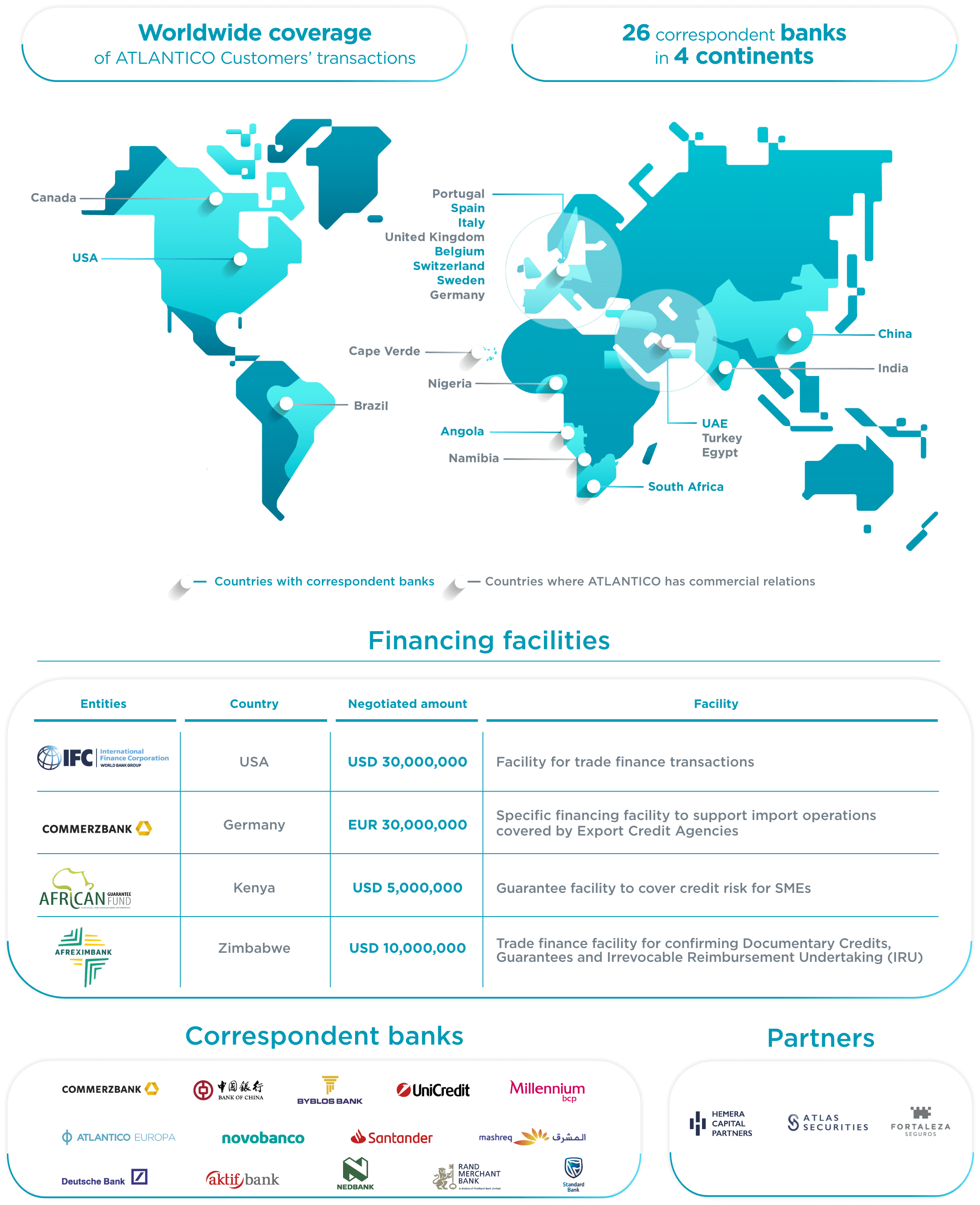

PARTNERSHIP’S ECOSYSTEM

ATLANTICO maintains its focus on its correspondent banking network, which consists of 125 banks (26 of which have active relationships). This network guarantees the consolidation of business through solutions such as the clearing service in various currencies, particularly the US dollar. As part of its PHIT 2.4 strategic plan, ATLANTICO has worked to strengthen its international partnerships concerning external financing lines, such as the AGF Credit Guarantee Facility and IFC Financing Settlement, as well as diversify trade finance and treasury lines, aiming to enhance its positioning in both domestic and international markets with products and services that drive the industrialization process and sustainable development.

ESG (ENVIRONMENTAL,

SOCIAL AND GOVERNANCE)

ATLANTICO's Transformation Journey

ATLANTICO has implemented several measures and actions to enhance its sustainability performance. As part of this journey, in 2023, the Bank began to develop its 2030 Sustainability Strategy, aligned with its vision, mission and values. To ensure a prosperous future for the Organization, it is essential to create a positive impact on society and the Bank's stakeholders. ATLANTICO is committed to contributing to the achievement of the United Nations 2030 Agenda and its SDGs by adopting solutions that extend to its entire value chain. The Bank acknowledges that a sustainable future presents numerous challenges. However, it also offers opportunities for business, innovation, evolution, and resilience. Adopting the 2030 Agenda and its SDGs will contribute to the greater good of the Organization and the Planet.

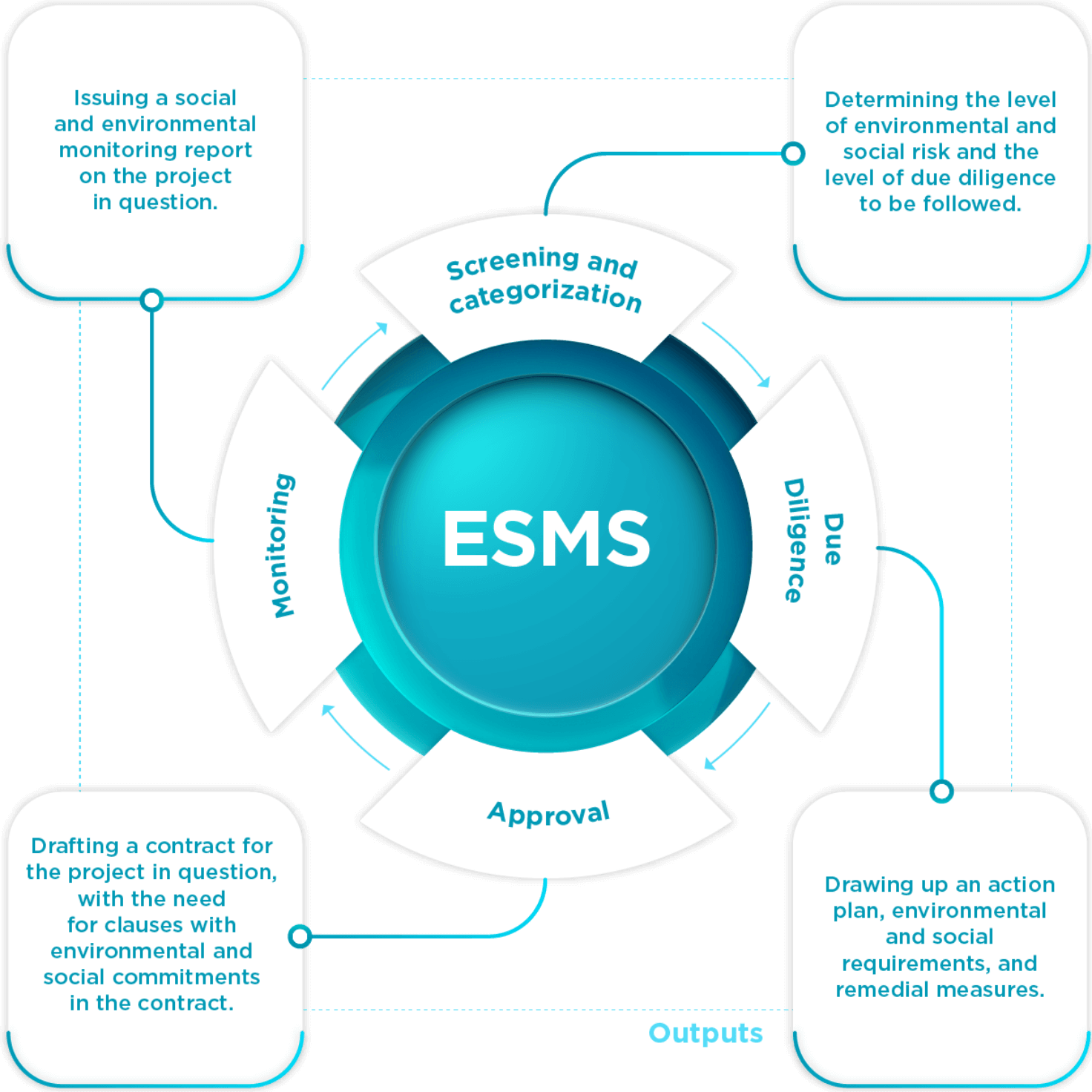

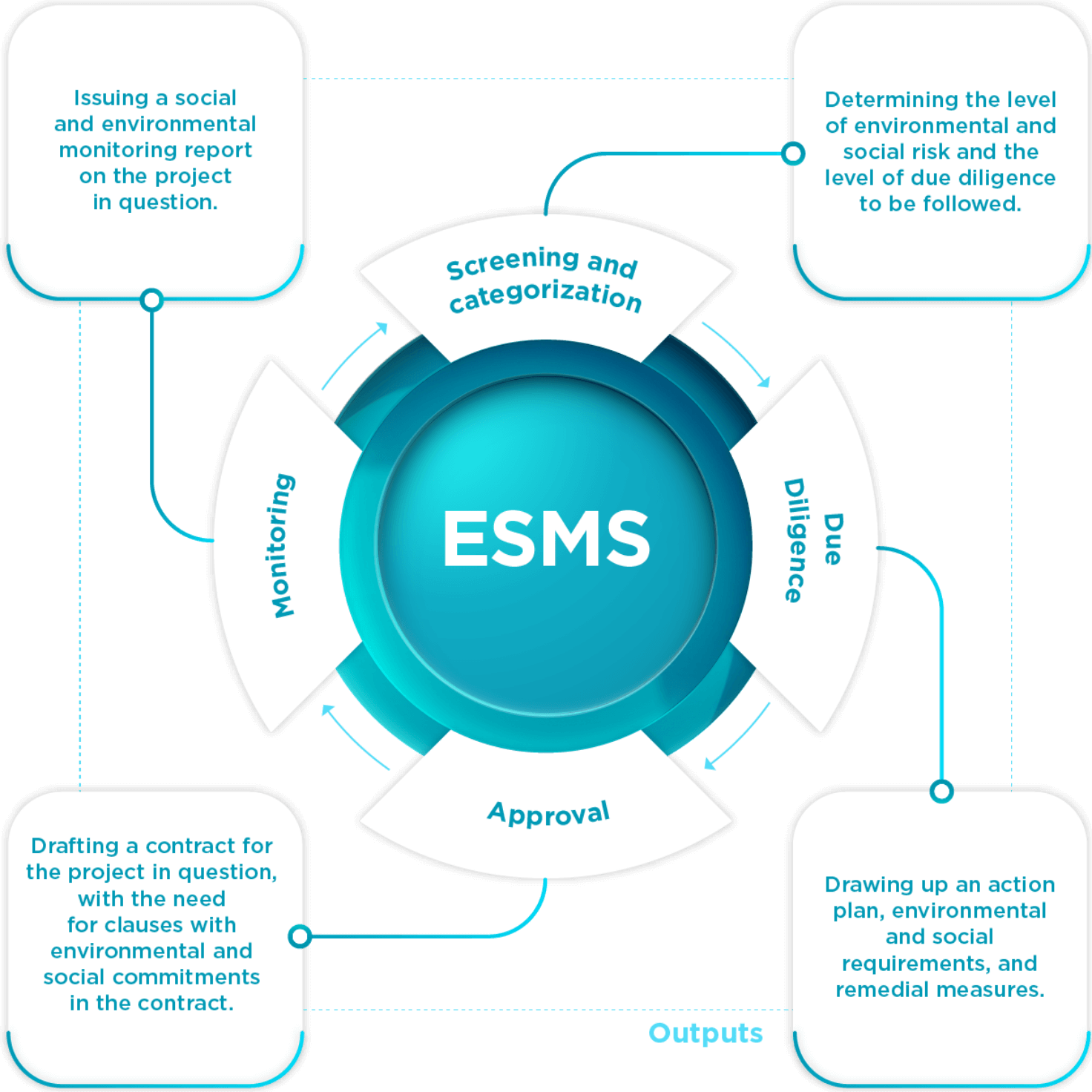

Environmental Dimension

ATLANTICO acknowledges that environmental concerns play a crucial role in establishing a robust and well-balanced organizational position. Effective management of these concerns can enhance efficiency and resilience. Thus, in line with its commitment to sustainability, the Bank has an Environmental and Social Management System (ESMS) in place to ensure that its activities comply with ESG requirements. As a result, the ESMS not only promotes transparency and awareness of environmental and social best practices, contributing to active engagement with customers, but also enables the implementation of sustainable solutions in relations with stakeholders throughout the value chain.

Social Dimension

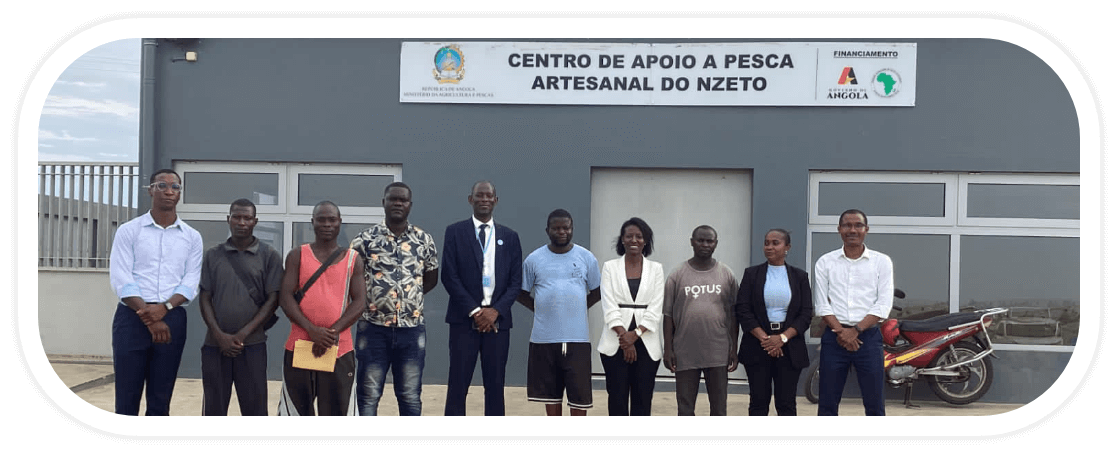

The “Malembe Malembe” impact loan programme aims to offer favourable conditions, such as affordable interest rates, flexible terms, and specialized technical support to artisanal fishers. This will enable them to enhance their practices, strengthen their operations, and achieve greater financial stability.

“MALEMBE MALEMBE” IMPACT LOAN PROGRAMME”

SUPPORT FOR ARTISANAL FISHERMEN

+ 19 households and micro-enterprises

included in the financial system

Capturing

and formalizing

this ecosystem of resources that is still mostly traded informally

+ 760

impacted people

With the motto, “Your cell phone is your bank”, *400# Agiliza puts financial potential in the hands of the entire population, with particular impact on low-income families living in remote areas and/or where access to structured financial services is non-existent or insufficient.

LITERACY, FINANCIAL INCLUSION AND INNOVATION

+ 1.3 million

users with access to *400# Agiliza through the USSD channel

+ 3.7 thousand

service points of *400# Agiliza Banking Agents, in the 18 provinces and in 77 municipalities of Angola

+ 250 actions

of financial and digital inclusion and literacy, with daily permanence in markets, neighbourhoods, and communities

+ 6.5 million

transactions *400# Agiliza, totalling + AOA 46.2 billion

+ 654 thousand

inclusion accounts opened on *400# Agiliza

Social Transformation

Social transformation is a foundational pillar of ATLANTICO, and it is in its DNA to share the results of its activity with the communities in which it operates, leaving a relevant mark on society. The Founders created an Institution based on creating Values for Life. An institution that generates value for its Customers, Shareholders, People and, above all, for the Communities.

Atlantico's social transformation strategy

ATLANTICO is continuously and increasingly committed to social transformation, impacting the lives of communities. Through the "Partilhamos Valores para a Vida" (“We Share Values for Life”) Programme, each Employee, with their gesture of solidarity, commitment, empathy, and love for others, has the opportunity to impact society positively and in a responsible and innovative way, inspiring dreams, helping to achieve goals and sustainable projects. a set of activities were carried out in 2023, which demonstrate and strengthen our strong sense of responsibility towards People. Committed to providing support to charitable institutions, around 993 Employees invested more than 3,848 hours in volunteer actions, impacting more than 1,600 people (children, young people, and the elderly). A Goods Collection Campaign was also held in favour of the institutions the Bank supports. These figures reflect the strong sense of mission of ATLANTICO volunteers.

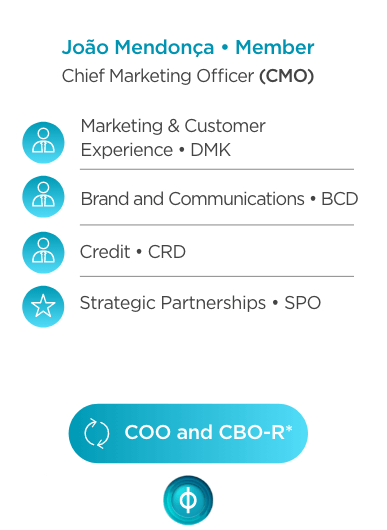

GOVERNANCE

Governance Model

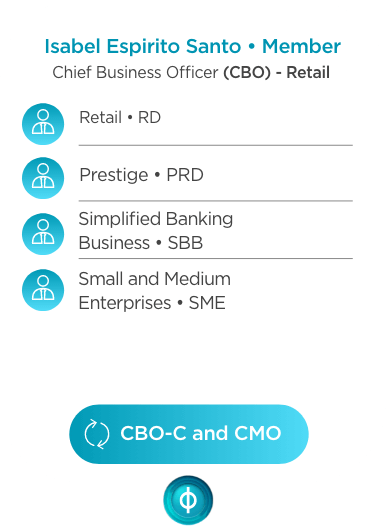

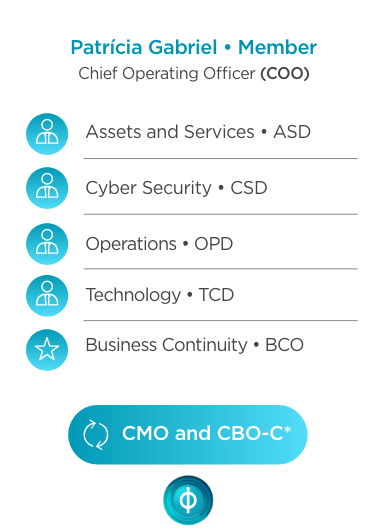

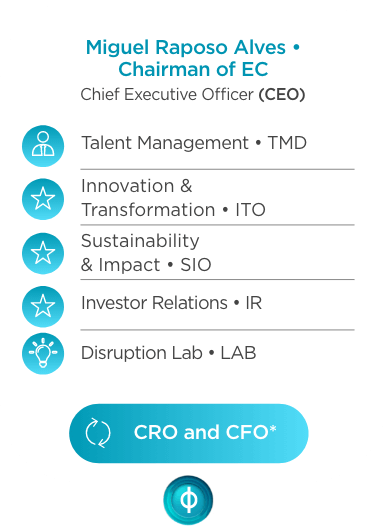

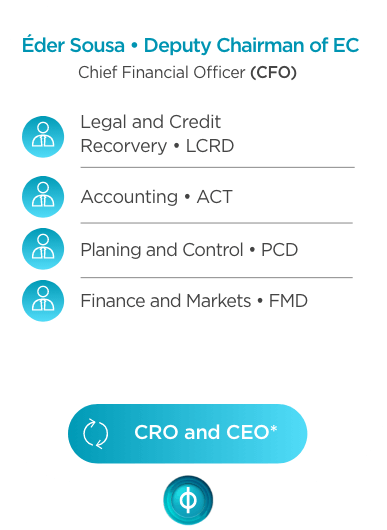

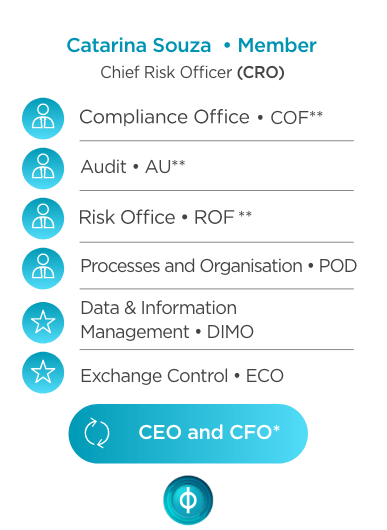

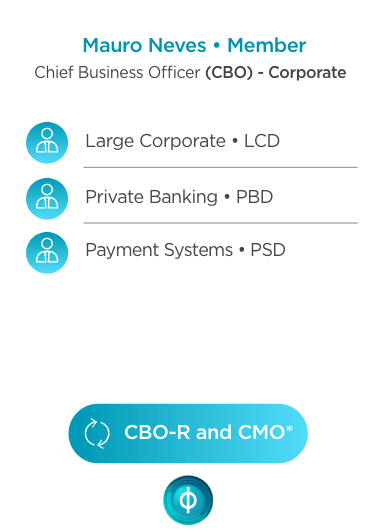

Executive Commission

Department

Office

Autonomus unit

Replacement

* The replacement order presented should only be applied in cases where the absent/prevented Board Member has not had the opportunity to directly appoint his replacement, with due caution regarding potential conflict of interest situations.

The CEO and the Deputy Chairman may adjust the appropriate division of areas of responsibility among themselves whenever one of them is absent/prevented from performing duties.

** Hierarchical reporting, with functional reporting to the Chairman of the Audit and Internal Control Commission for Compliance Office and Internal Audit, and to the Chairman of the Risk Committee for Risk Office.